Covid-19 – The good, the bad and the ugly truth

Learn Forex Trading

The Ugly: As the coronavirus spreads across the world, soaring above 10, 000 daily new cases, panic also surges across almost all segments of society. Hoarding is just one example — toilet-paper is becoming one of the most “precious” commodities nowadays! Needless to say, in some cases supermarket shelves are empty. “Wash your hands frequently” they say, as sanitisers become the new “extinct species”. As more restrictions come into effect and lockdown in some parts of the world is imminent, people find themselves spending more time online. Social media is becoming the new source of information, often with a lot of inaccuracies circulating around. Allow me to say that this fake news create havoc. The blame game has already started. Countries, governments, presidents… even prominent benevolent citizens have been blamed on the quest for hits, followers and popularity to name a few.

The Bad: China has managed to control the virus outbreak in almost two months, but it unfortunately received little to no publicity or acknowledgement. What have we learned so far from China? What measures did they put in place? Have we asked? Well, positive news does not really sell! South Korea is also following the footsteps of China. The number of new cases is lower! So, there is light at the end of the tunnel — we just have to look in the correct direction.

The Good: They say markets have crushed, airlines are facing difficult times, Oil has plummeted badly (reaching as low as 20 US Dollars per barrel) and Gold has lost more than 200 US Dollars per troy ounce! When trading the financial markets, all these factors mean opportunities. Rising markets offer buy (long) opportunities where falling markets offer sell (short) opportunities. The most important thing for a trader to do is to be on the right direction and ride the trend. Protective stop loss is imperative, and I am sure the advocates of the opposite have a great number of “horror” stories to tell. This is not the time for “ego boosting”. Instead, this is the time to look at the price charts closely and identify the very early stages of the new trend.

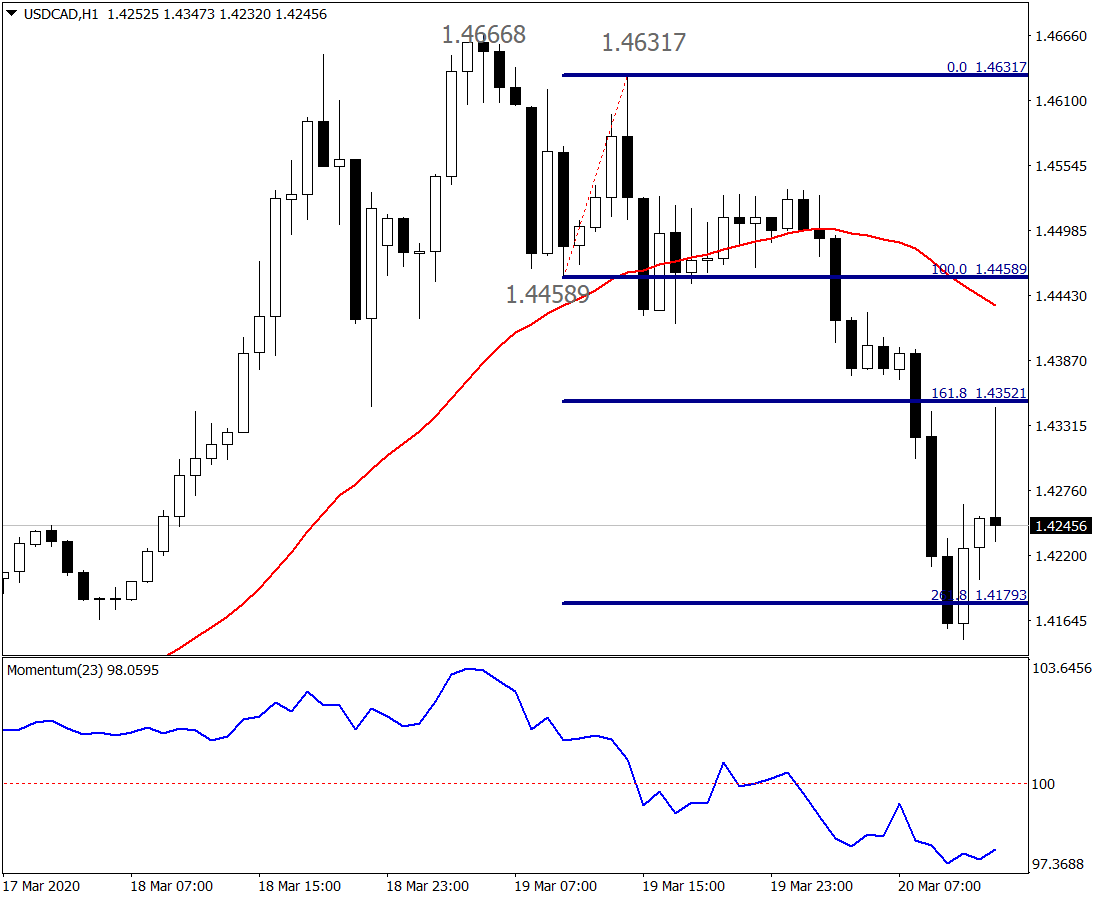

The Loonie: Going back to basics, technical analysis is not concerned with why the markets rise or fall. On the contrary — it is more interested on the effect of the causes. After all, price is the boss! Just take a look at the price charts and the effect will be there. Let’s take a look at the USDCAD — or ‘Loonie’ as it is also popularly known.

On the hourly chart, the Loonie had been following an upward direction since 21 February 2020. This was evident as prices followed a path of higher tops and higher bottoms, a pattern that defines the uptrend. Subsequently, on 19 March 2020, buyers lost momentum and sellers took control of the market. More precisely, the market reached an all-time high price of 1.46668 for the period under study. Furthermore, as the bears entered the market, the Loonie fell lower to form a bottom at 1.44589. The bulls then found the prices attractive and entered the market with buy positions. Unfortunately for them, their buying power has been proven to be weak as the market formed a new top at 1.46317, which failed to exceed the previous top. In technical analysis, this is a warning. Prices subsequently fell below the bottom at 1.44589, forming a reversal to the downside. This opened the way for sellers to enter the market. Attaching the Fibonacci tool on the bottom (1.55589) and dragging it up to the top at 1.46317, three potential price targets may be calculated. The first price target seen at 1.43521 (1.618) has already been reached. The second price target estimated at 1.41793 (2.618) has also been achieved. The third price target is computed at 1.38997 (4.236). Of course, time will tell whether the sellers will maintain the control of the market and manage to drive the USDCAD lower.

Conclusion: There is no doubt that during these dire times that we are all experiencing, precaution is key. Yes, wash your hands. Stay home if needed, get your information from valid sources and avoid falling in the trap of the crowd/herd psychology. On the other hand, look for signals on the charts that a new trend is being formed. Volatility might bring trading opportunities, where panic will not.

Remember, however, that trading during periods of volatility also entails risk.

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.