The Stochastic Oscillator

Learn Forex Trading

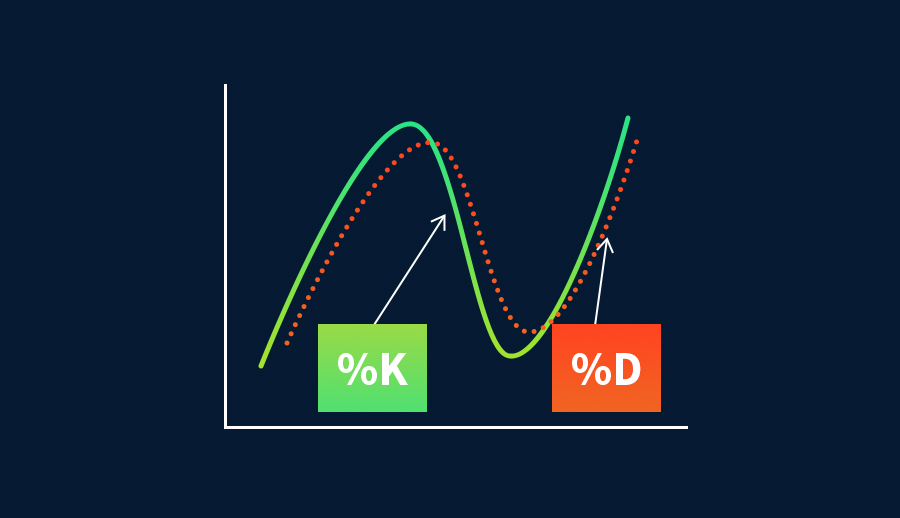

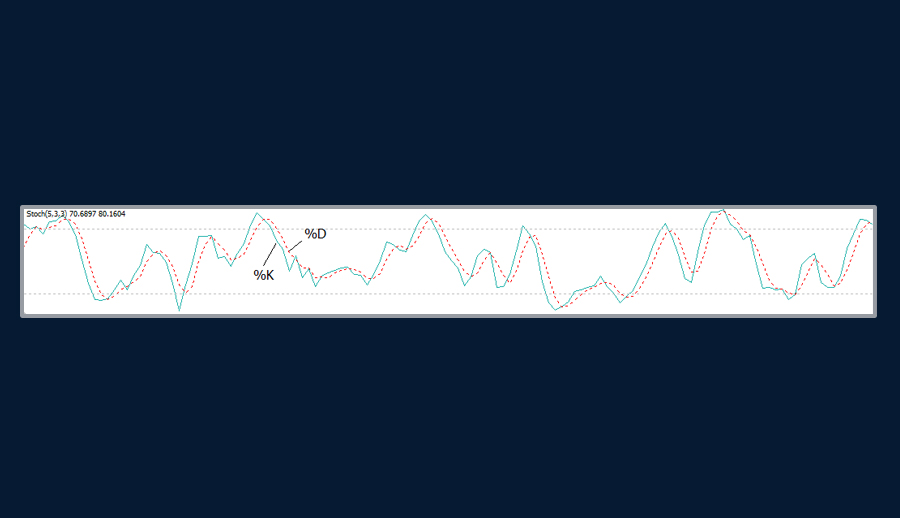

The Stochastic Oscillator is a very popular technical analysis tool, available on almost all trading platforms and used by many traders all over the world. It was developed by George Lane, a famous technical analyst, based on the premise that prices tend to close near the high of the candlestick during upward price movements, and near the lower end of the candlestick during downward movements. Similarly, the Stochastic determines where the price closed in relation to a specific price range over a chosen time period. During an uptrend prices tend to close near the top of a specific range, whereas during a downtrend they cluster near the bottom. The Scholastic Oscillator consists of two lines; %K and %D. Major signals are generated using %D.

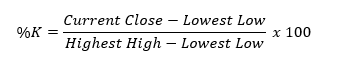

Fast Stochastics Formula

The most popular periods for Stochastics are 5 and 14. During volatility the period of 5 or 9 is used, whereas the period of 14 is widely used for the rest of the markets.

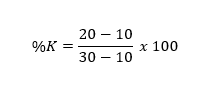

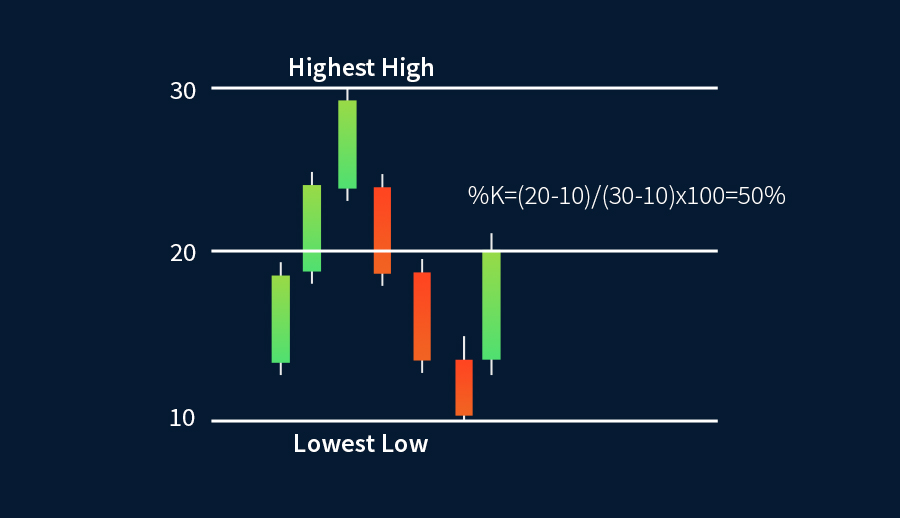

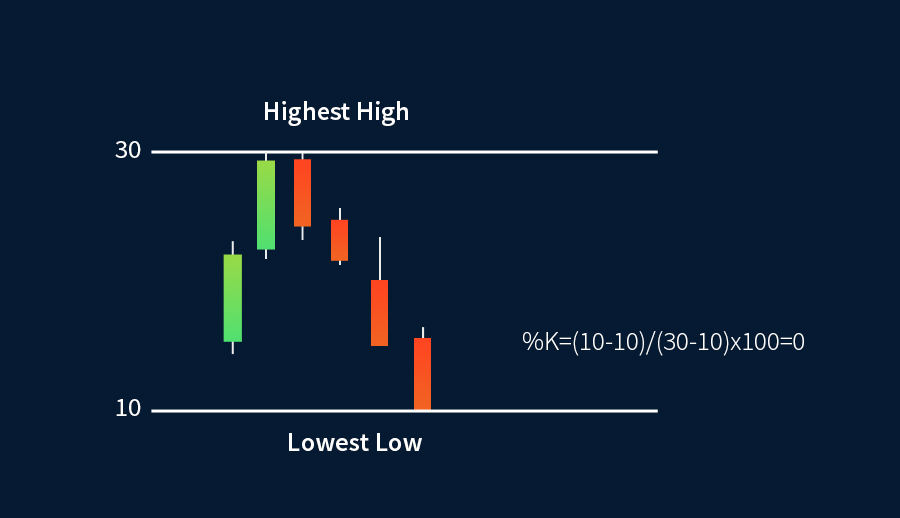

Assuming a period of 5, a highest high of 30, a lowest low of 10 and a current close of 20, the formula above can be used the calculate the %K line:

The %K determines where the price closed in relation to a range (i.e. period) of candlesticks. For example, a reading above 80 implies that the current closing price is near the highest high of the range, which is in fact the highest price of the last 5 candlesticks. On the other hand, a reading below 20 puts the closing price near the lowest low of the range, which is in fact the lowest price of the last 5 candlesticks.

The second line, %D, is estimated by smoothing %K. Simply put, it is the 3-period simple moving average of %K:

%D = SMA (%K,3)

This is known as a Fast Stochastic.

Slow Stochastics

Fast Stochastics produce early signals, meaning that a further smoothing of the %K and %D lines is preferred by many traders.

By taking an additional 3-period Simple Moving Average of %D and %K, the corresponding Slow Stochastics are calculated as follows:

%K = SMA(%K,3)

%D = SMA(%D,3)

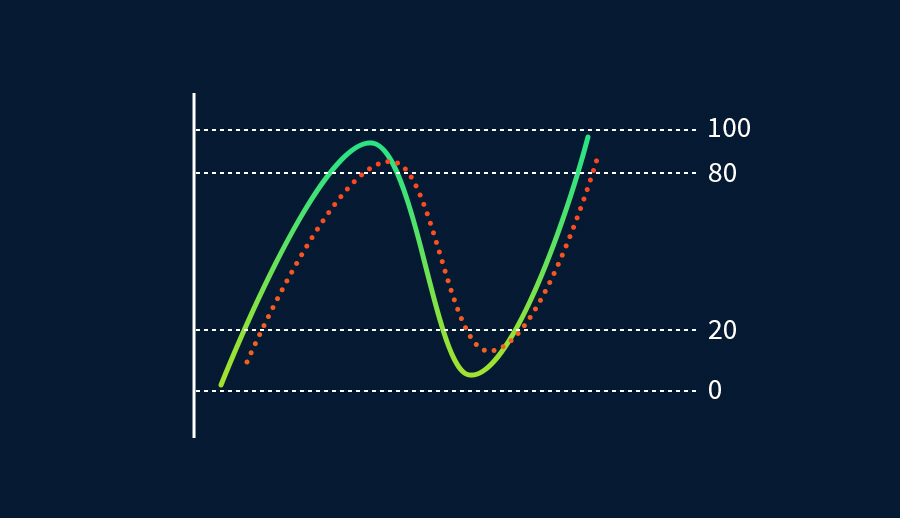

The Stochastic Oscillator ranges between 0 and 100. A reading of 0 means that the latest closing price is equal to the lowest price of the price range over the chosen time period.

A reading of 100 means that the latest closing price is equal to the highest price recorded for the price range over the chosen time period.

A reading above 80 is considered to be an indication that the market has reached extreme overbought levels, whereas a reading below 20 indicates that the market has declined to extreme oversold levels.

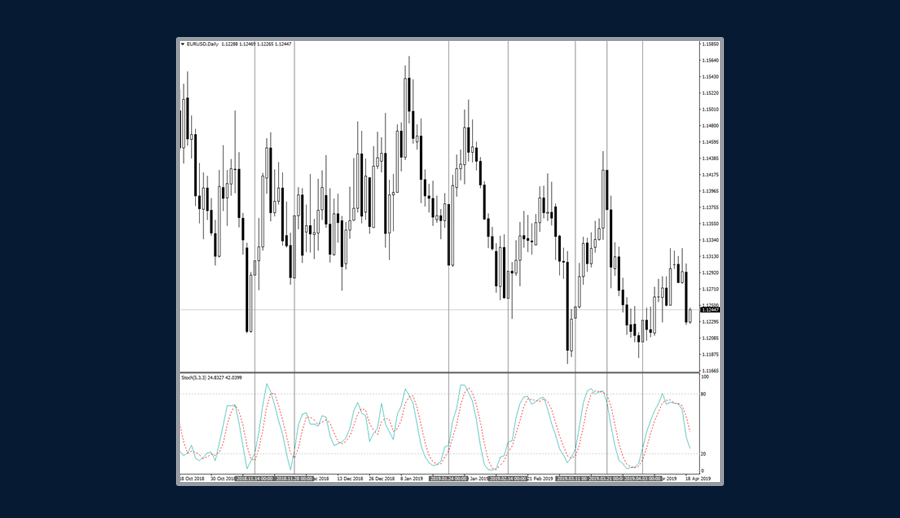

Buy and Sell Signals

A buy signal is generated when both %K and %D lines fall and cross over below the 20 oversold level. For further affirmative signals, traders may also wait for the %D line to rise above 20.

Conversely, a sell signal is generated when both %K and %D lines rise and cross above the overbought level of 80. Once again, if additional confirmation is required then traders wait for %D to fall below 80. It is worth noting that some traders wait for %K instead of %D to fall below the overbought level or rise above the oversold level to initiate an entry in the market. Similarly, for faster signals, traders watch the %K line instead of the slower %D line.

Apart from the 20 and 80 extreme levels, traders may also use the 30 and 70 levels at times. When trend-following indicators fail during sideways markets, the Stochastic Oscillator may produce timely signals.

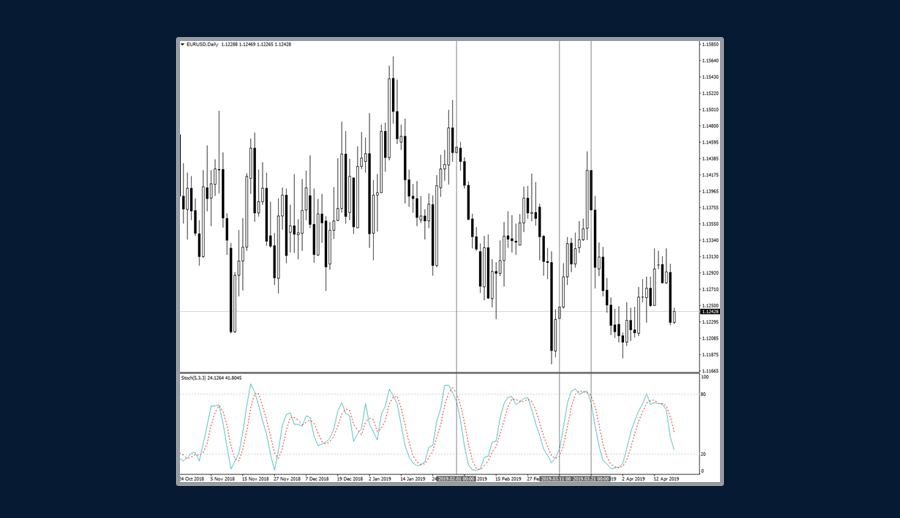

Stochastics and Divergence

Apart from the oscillation of Stochastics between 0 and 100 and the crossing of the fast line, %K, and the slow line, %D, divergence may also by incorporated for signals.

A bearish divergence occurs when the slow line (%D) rises above 80 and forms two successively lower tops while the price rallies. Similarly, a bullish divergence occurs when both %K and %D fall below the oversold level of 20, and %D forms two successively higher bottoms while the price continues to decline.

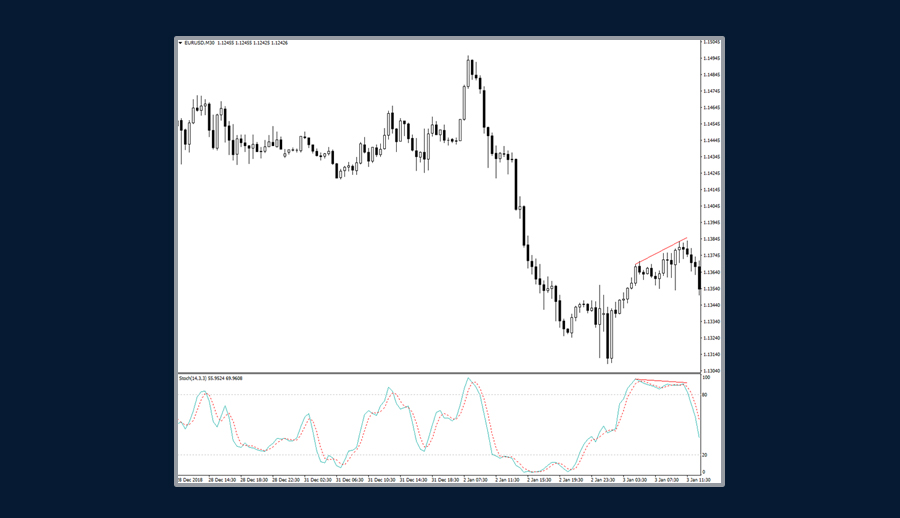

Combination of Stochastics with RSI

Stochastics may also be combined with the popular Relative Strength Index (RSI) for potentially more precise signals and alerts.

For example, if the RSI is in the overbought area above 70, and %K and %D cross above 80, then this might produce an alert for an impending turning point on the price chart.

On the other hand, if the Stochastics cross below the 20 oversold level and the RSI is also below 30 then this might produce a bullish alert.

Conclusion

The Stochastic Oscillator is used by beginners and advanced traders alike. It is useful in both trending and ranging markets as it produces a varied range of signals. A crossover of the Stochastics above the overbought level or below the oversold level may be more common in a sideways market. On the other hand, a divergence (either positive or negative) between the oscillator and price may be more common during trending markets. It is wise to note that indicators and oscillators are better tools when they are combined with others, including, and especially, the price itself.

Learn to trade with FXTM

Discover how to make the right trading decisions for your style and goals with our comprehensive range of educational resources. Learn from home when and how it suits you with our educational videos or sign up for a remote webinar. We also host on-location, interactive forex seminars and workshops around the world – there might be one coming to your area soon!

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: There is a high level of risk involved with trading leveraged products such as forex and CFDs. You should not risk more than you can afford to lose, it is possible that you may lose more than your initial investment. You should not trade unless you fully understand the true extent of your exposure to the risk of loss. When trading, you must always take into consideration your level of experience. If the risks involved seem unclear to you, please seek independent financial advice.